Digital Therapeutics Global Market Map (2025)

Fill in form to get access to the full dataset including links to all relevant products and companies.

Digital therapeutics (DTx) have evolved from experimental pilots to a rapidly maturing global industry, now spanning hundreds of regulated and commercialized products across all major regions and therapeutic areas, in spite of some big setbacks over the last few years.

Fueled by chronic disease burdens, tech-driven patient engagement, and early regulatory buy-in (FDA, CE, PMDA, MFDS, NMPA), the DTx market is growing at ~20%-30% CAGR, projected to exceed $15B by 2030..

Big Pharma and payers are actively exploring companion DTx for drug portfolios, as well as stand-alone additions to given indications.

Prescription vs. Wellness: Distinct Paths, Increasing Convergence

Prescription DTx (Rx, regulated)

In our dataset, +60% of products are fully regulated as FDA/CE/PMDA/MFDS/NMPA cleared, often prescription-only, targeting serious conditions with rigorous evidence from randomized control trials (RCT).

This is a very slow but secure market: it depends on reimbursement or employer coverage and requires a rigorous regulatory pathway. .

Wellness / OTC DTx

Roughly 20% of the products in our dataset are consumer-led, often without explicit regulatory approvals, instead marketing under wellness or “prevention”. However, these are products with large user bases and a simpler business model - usually out of pocket subscription or employer health benefits. They have variable clinical validation.

There are also digital therapeutics that have an uncertain status - most of them in China where unique operating frameworks (influenced by state or government support, large scale experimental deployments/ sandbox) do not allow for a clear-cut prescription vs. wellness categorization.

Geographic Breakdown

United States/ North America

The largest concentration of regulated DTx in our dataset are US based. However, Medicare / large-scale payer reimbursement is still limited/ unclear, slowing broad adoption.

Investment continues even after the shock of Pear Diagnostic’s bankruptcy in 2023. Click Therapeutics acquired Better’s diabetes DTx, expanding prescription based offerings. Big Health, Akili, and others have been moving to direct consumer channels to offset payer lag.

Europe

In Europe Germany dominates via the DiGA framework. Products on the market regulated under DiGA cover mental health, insomnia, metabolic, MSK, and some even niche indications like ED.

Germany paid €263M on DTx over 4 years, with 870K patient activations, proving insurer willingness. Belgium, France, UK are building their own frameworks, creating multi-country European expansion plays.

While Mental Health features prominently in the pipeline, more “clinical” therapeutic areas are well represented, such as in Beyer’s acquisition of Cara Care, an IBS Dtx.

Asia-Pacific

Asia-Pacific seems to be the fastest growing market globally, driven by local regulatory tracks and strong tech ecosystems (AI+IoT).

China

is clearly the largest market by absolute volume (~235 NMPA approvals) but very local and localized. The majority of the products seem to be focused on neuro/ cognitive conditions and many are linked to hospitals or state pilots. This also makes it hard to classify these products as simply OTC or Prescription based.

Several large Chinese Consumer Technology companies (Alibaba, Huawei, Tencent) are pioneering Dtx, including with the addition of peripherals such as VR headsets or dedicated devices.

Japan/Korea

Japan and Korea were early movers in Dtx with early prescription approvals (smoking, hypertension, insomnia, stroke rehab), with tight physician oversight and good adoption in aging populations. There are several pharma partnerships aimed at bringing to market prescription digital therapeutics - see Kyorin Pharma’s strategic partnership with Hyfe inc. aimed at chronic cough.

Therapeutic Areas

High Level Trends

- Prescription DTx will continue to command payer-driven margins while wellness/OTC will drive volume and direct engagement. Both paths now blur as payers demand real-world evidence even from wellness players.

- Next 2–3 years likely to see a wave of consolidation, new reimbursement codes, and pharma companion launches. Pharma and larger players are likely to acquire for portfolio breadth or as a way to aggregate multiple conditions.

- Growth of multi-modal platforms. While the early generation Dtx were mostly Smartphone Apps or web based, latest generations are often combining wearables, video, sensors, VR, tDCS (Flow Neuroscience for depression), remote coaching (Virta, Hinge).

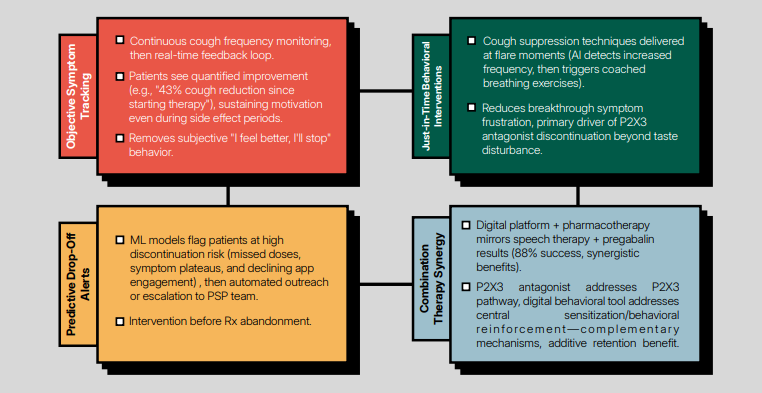

- AI-driven personalization features in most late generation Dtx. Some of them integrate AI for coaching (e.g., Tencent’s MindFlex, Alibaba PainGo or Hyfe’s CoughPro), as well as for real-time feedback loops (Hyfe’s Chronic cough Dtx).

- Drug Adjacent DTx are a clear trend, potentially facilitated by the US PUDRS Framework. These enhance adherence, persistence and/ or differentiating crowded drug classes (e.g., diabetes, depression, cough).

- Active reimbursed environments (Germany, Korea) likely to show significant growth. Any clinically validated DTx can localize for rapid payer access. China remains a desirable market but localization for western companies remains complicated.

- If Medicare bill passes in the US, this will unlock large over-65 market, particularly for diabetes, insomnia and other chronic conditions.

Know of a DTx we're missing? Submit the information about it here and we'll make sure to add it to the list.

Fill in form to get access to the full dataset including links to all relevant products and companies.

Our latest news

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Non eget pharetra nibh mi, neque, purus.